Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

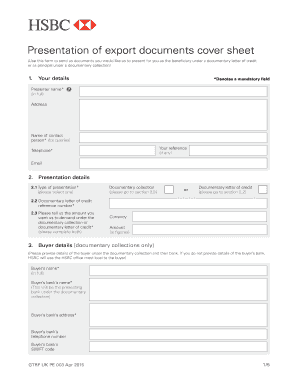

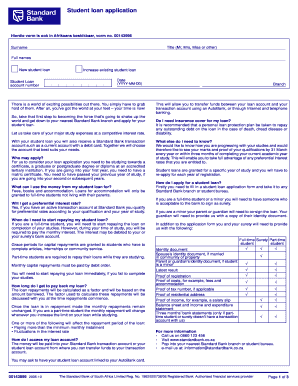

What is the purpose of letter of credit template?

A letter of credit template is used to provide a bank or other financial institution with a standard set of instructions when issuing a letter of credit to a client. The template outlines the necessary information, such as the amount of money to be paid, the type of credit, the terms and conditions, and the parties involved. The template also helps to ensure that all pertinent information is included in the document and that all parties are aware of the terms of the credit.

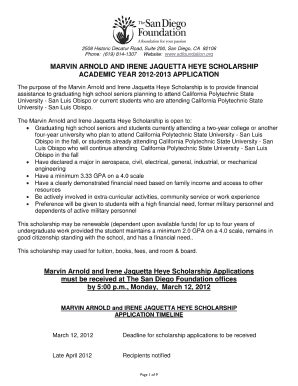

When is the deadline to file letter of credit template in 2023?

The exact deadline to file a letter of credit template in 2023 will depend on the specific terms of the letter of credit agreement. Generally speaking, the deadline to file the letter of credit template is usually within a few weeks of the date of the agreement. However, it is important to check the specific terms of the agreement to determine the exact deadline.

What is the penalty for the late filing of letter of credit template?

The penalty for the late filing of a letter of credit template varies depending on the terms and conditions of the agreement between the parties involved. Generally, late filing of a letter of credit template may result in financial penalties, such as a delay in payment or the imposition of additional charges. In some cases, the issuing bank may even choose to cancel the letter of credit if it is not filed in a timely manner.

What is letter of credit template?

A letter of credit template is a standardized document that includes the necessary information and terms typically required in a letter of credit. It serves as a guide for drafting a letter of credit and helps ensure that all the important details are included. The template may include sections for the name and address of the issuer, beneficiary, and applicant; the amount and currency of the credit; the expiration date; the terms and conditions for payment; the documents required for presentation; and any special instructions or provisions. Using a letter of credit template can streamline the process of creating a letter of credit and help maintain consistency and accuracy.

Who is required to file letter of credit template?

The party that is requiring the letter of credit is the one who typically files the letter of credit template. This could be a buyer, a seller, or a financial institution involved in the transaction.

How to fill out letter of credit template?

Here is a step-by-step guide on how to fill out a letter of credit template:

1. Letterhead: Begin by inserting your company's letterhead at the top of the document. This should include your company name, address, contact information, and logo if applicable.

2. Date and Reference: Include the date of the letter and a reference number if desired. The reference number can be used for easier tracking and identification of the letter.

3. Recipient Details: Next, provide the details of the beneficiary or recipient of the letter of credit. Include their name, address, and contact information. This is important for ensuring the letter reaches the intended recipient.

4. Opening Statement: Start the body of the letter with a formal opening statement. This may include a salutation such as "Dear Sir/Madam" or a specific recipient's name followed by a colon.

5. Purpose: Clearly state the purpose of the letter of credit. Specify if it is for the purchase of goods, services, or any other transaction. Be precise and concise in describing the purpose.

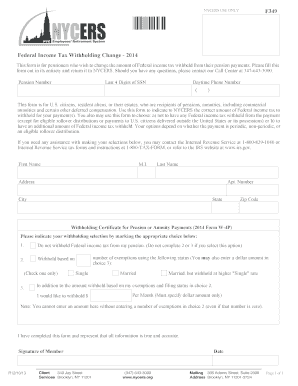

6. Terms and Conditions: Lay out the terms and conditions agreed upon for the letter of credit. Include the duration, expiration date, and any specific requirements or conditions that need to be met for the beneficiary to access the funds. This section should be detailed and provide all necessary information for the recipient to understand the terms.

7. Payment Instructions: Provide clear instructions on how payment should be made. Include information about the currency, amount, and required documentation or proofs for payment to be processed.

8. Contact Information: Include your contact information as the issuer of the letter of credit. This should be your name, position/title, phone number, and email address. This allows the recipient to contact you if they have any questions or need further clarifications.

9. Signature and Company Seal (if applicable): End the letter by signing it and, if applicable, affixing your company seal. This adds an official touch to the document and certifies its authenticity.

10. Copies: Keep copies of the letter for your records and send the original to the recipient via the desired delivery method, such as email or registered mail.

Note: It's important to consult with legal or financial professionals when dealing with letters of credit to ensure compliance with relevant laws and regulations.

What information must be reported on letter of credit template?

The information that must be reported on a letter of credit template includes:

1. Issuing bank details: The name, address, and contact information of the bank issuing the letter of credit.

2. Applicant details: The name, address, and contact information of the buyer or importer who requested the letter of credit.

3. Beneficiary details: The name, address, and contact information of the seller or exporter who will receive the payment.

4. Letter of credit number: A unique identification number assigned to each letter of credit.

5. Date of issuance: The date on which the letter of credit is issued by the bank.

6. Expiry date: The date on which the letter of credit will expire and become invalid if not utilized.

7. Amount: The total amount of money that the bank is willing to pay to the beneficiary as specified in the letter of credit.

8. Currency: The currency in which the payment should be made.

9. Description of goods/services: A detailed description of the goods or services being traded, including the quantity, quality, and any relevant specifications or codes.

10. Shipping terms: The agreed-upon terms for the transportation of the goods, including the mode of transportation, routing, and delivery instructions.

11. Documents required: A list of the documents that the beneficiary must present to the bank to receive payment, such as a commercial invoice, bill of lading, packing list, insurance certificate, etc.

12. Terms and conditions: Any additional terms and conditions agreed upon by the buyer and seller, such as payment terms, inspection requirements, and dispute resolution procedures.

It is important to note that the specific information required may vary depending on the type of letter of credit, such as a confirmed, unconfirmed, irrevocable, or revolving letter of credit, and the requirements of the issuing bank and the parties involved in the transaction.

How can I edit letter of credit template from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including letter of credit forms. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete hsbc letter of credit department online?

pdfFiller has made filling out and eSigning standby letter of credit sample easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete documentary letter of credit sample on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your standby letter of credit template form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.